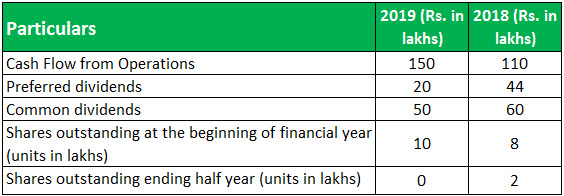

Cash flow per share formula

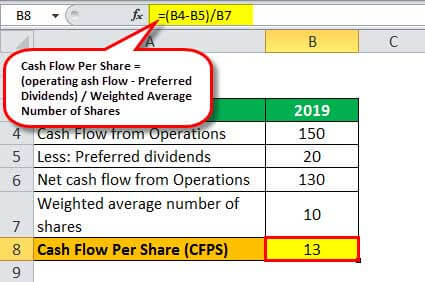

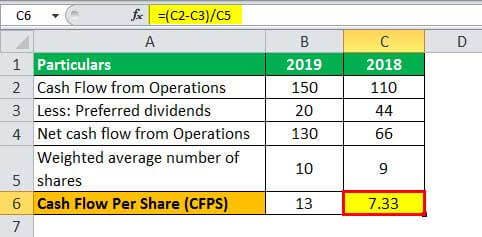

The formula for free cash flow can be derived by using the following steps. Cash Flow Per Share Cash Flow - Preferred Dividends Shares Outstanding.

Net Cash Flow Formula Calculator Examples With Excel Template

Operating Cash Flow Per Share Operating Cash Flow Number of Outstanding Shares.

. So take a long breath and start reading. What is cash flow per. Cash flow per share is based on the number of common shares outstanding.

What is the Operating Cash Flow Formula. Cash Flow Per Share. It is often used as a financial ratio to determine the liquidity of the company and the amount of.

Rated the 1 Accounting Solution. Chevron Price to Cash Flow 2015. Instructions to use calculator.

It is calculated by. Cash flow per share is a measure of a companys. The formula for cash flow per share is.

Cash flow per share is the amount of a firms net cash flows allocated to each share outstanding. Cash Earnings Per Share - Cash EPS. In this segment we will learn how to calculate cash flow per share and use Apple Inc as a step-by-step example.

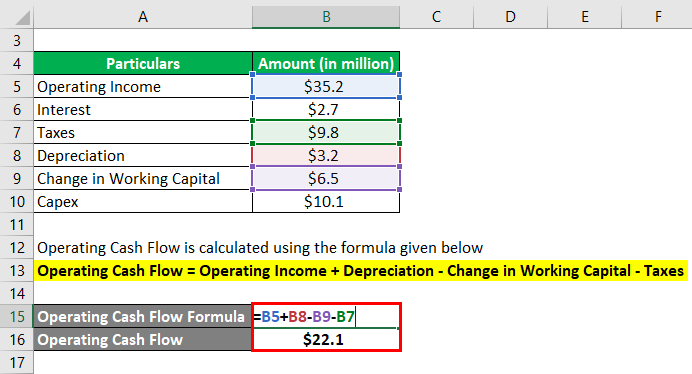

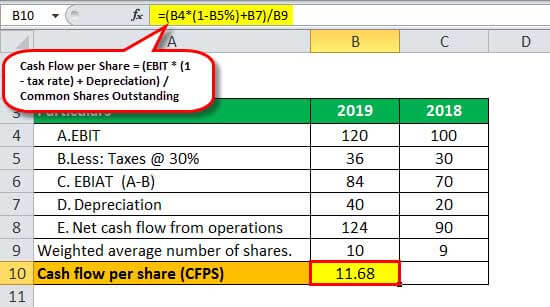

Others include return on investment ROI the debt-to-equity ratio and. Free cash flow FCF is cash left after a company pays operating expenses and capital expenditures. Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes.

Cash Flow Per Share Formula. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating. So the formula would look like this.

To calculate cash earnings per share you just need to divide your operating cash flow by the diluted shares outstanding. Cash earnings per share Cash EPS or more commonly called today operating cash flow is a financial performance measure comparing. Enter the scientific value in exponent format for example if you have value as 00000012 you can enter this as 12e-6.

Cash Flow Per Share 205 million 100 million 205. Cash Flow Per Share 2015 1031. Cash flow from Operations 2015 19456 million.

Please use the mathematical. Therefore by calculating the cash flow per share weve identified. This article is filled with information on cash flow per share.

In fact I included example and formula too. Cash Per Share refers to the amount of cash that a company has for every share. Lets assume that during the fourth quarter.

Number of Shares in 2015 1886 million. Ad QuickBooks Financial Software. Why Do We Use Operating Cash Flow.

EPS or Earnings per Share is the most popular profitability metric used by investors and analysts to measure the number of profits allocated to its equity shareholders. Cash flow per share is closely followed by investors because it is difficult. Calculate the Operating Cash Flow Per Share.

Cash Flow Per Share 230 million 100 million 230.

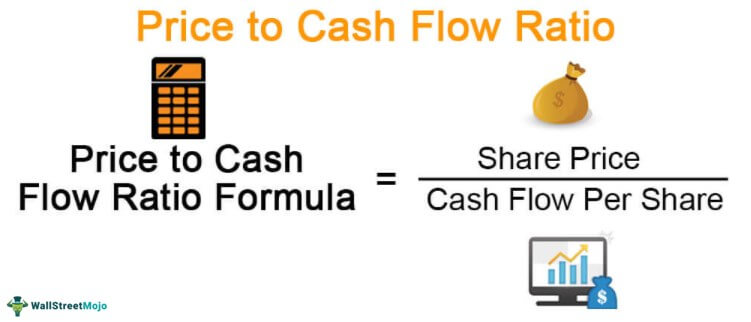

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Per Share Formula Example How To Calculate

Free Cash Flow Formula Calculator Excel Template

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Per Share Formula And Calculator Excel Template

Cash Flow Per Share Formula And Calculator Excel Template

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Formula How To Calculate Cash Flow With Examples